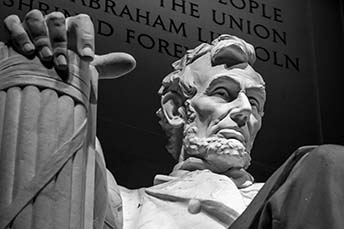

The top ranked activities to do in the US according to TripAdvisor travelers are: Lincoln Memorial (DC), Horseshoe Casino (MD), Sugarlands Distilling Co (TN), Chihuly Garden and Glass (WA) and Louisville Mega Cavern (KY). It's time to get active.

Bankers actively think about many things in their business model. These include how to make better use of data, filling in gaps with the data needed, and most importantly, analyzing all this information to determine the best courses of action.

Data analytics is not only becoming more important to financial institutions of all sizes, but will be necessary to help them with capital development, according to recent research by Aite Group. Not only that, it is a means to better stay compliant and secure and perform better for customers.

But this is still a relatively recent development, compared to how data analytics has been embraced in other areas of the financial industry. The founder of at least one analytics-based investment firm said that when his firm launched in 2013, there had been "no technological innovation in private equity since the invention of the Excel spreadsheet." In the past half-dozen years, using data analytics to determine their investment path, the firm has been involved in more than $27B in transactions.

So, how can you take a page from these efforts to better implement data analytics into your own capital development operations? Here are a few ideas:

- Consider the importance of data throughout the industry. Community financial institutions rely on many manual processes. Yet, research firm IDC forecasts that global revenue for Big Data and business analytics solutions will grow 12% this year over 2018, with the pace of growth expected to continue in the upcoming years. Although it may seem like a big leap, dipping your toe into the Big Data pond may not be a bad idea. One idea may be to start with a small project and then build from there.

- Be aware of the "disconnects" in the data. Oftentimes, a close analysis of the multiple streams of data can reveal insights that fly in the face of conventional wisdom. When these surprises emerge, they may be met with controversy or disbelief. Since projects can require you to analyze large amounts of data, it's important to stay open to new emerging realities, so as to best decide how to proceed most effectively.

- Enjoy more efficiency and accuracy in planning. According to a report from McKinsey & Co., at least one bank was able to reduce customer churn by 15% after investing in data analytics.