PCBB Announces Check Imaging for Canadian Cash Letters

WALNUT CREEK, Calif. — December 5, 2017 — PCBB, a leading bankers’ bank serving community-based financial institutions across the entire U.S., announced the availability of

check imaging for Canadian cash letters. This service digitizes Canadian check processing to minimize a bank’s credit exposure, increase operational efficiency and deliver faster fraud notification.

Seventy-five percent of organizations said they experienced check fraud in 2016 — an increase of 71% over the previous year, according to the 2017 AFP Payments Fraud and Control Survey. This can put banks in a position of credit risk, especially when paper processing takes up to 7 days to clear a Canadian check. PCBB is pleased to be the first bankers’ bank to offer check imaging for Canadian cash letters (USD and CAD), which digitizes the process, allowing for a speedier turnaround of provisional credit and reduced credit risk with quicker fraud alerts.

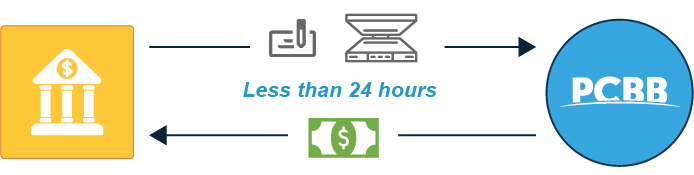

“Check imaging is important to banks since they can now receive provisional credit within 24 hours for their Canadian items instead of the 7 days it takes with paper processing,” states Patricio Morillo, Senior Vice President of International Services at PCBB. “With a $628 billion Canadian import/export market, we’ve seen firsthand with our international customers that a vast majority of the international cash letters being processed are Canadian. Now we can provide those banks with quicker service and more confidence in their risk exposure.”

The solution is extremely easy to use through PCBB’s comprehensive, secure cash management platform — enter in the check details, scan a copy of the check and hit submit. Check imaging for Canadian cash letters, which was soft-launched in November to clients, offers check imaging at no additional cost to the cash letter service.

Check Imaging For Canadian Cash Letters

PCBB believes in the power of local financial institutions to be the catalyst of small business growth and to enable communities to thrive. Our team is committed to providing not only the tools and knowledge our customers need to serve their clients, but also the partnership and trust they deserve.