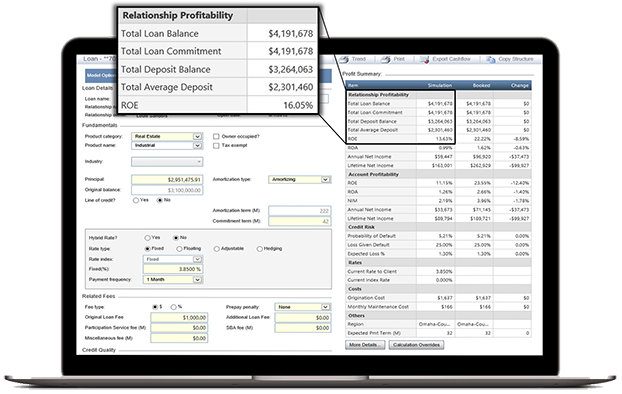

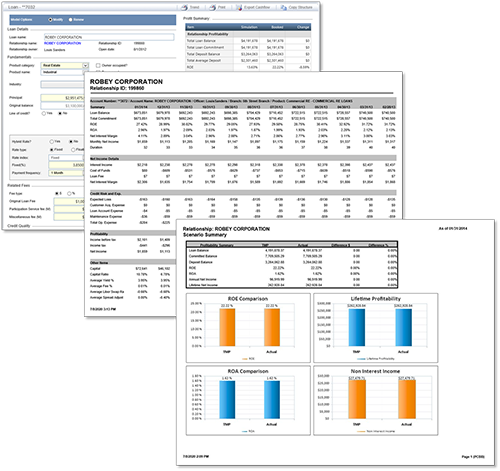

Loan Pricing and Profitability Analysis

Optimize Deposit Pricing Through Profitability Modeling

Profitability FIT™ is a profitability analysis tool used by thousands of bankers to identify valuable cross-selling opportunities and optimize loan, deposit, and relationship pricing to achieve increased profitability and performance.

Tap into our advisors for their expertise and guidance, and take advantage of our data mining features and e-Consultant for quick, easy insights.

Gain insights into:

| Cross-sell opportunities | |

| Lifetime risk-adjusted profitability | |

| Share of wallet | |

| Strategies to increase revenue from unprofitable loans and customers | |

| Underutilized credit lines | |

| Loan-only and CD-only customers | |

| Significant overdraft customers | |

| High cost of funds customers |

Case Study: OceanFirst Bank Achieves Profitable Growth

With Profitability FIT, OceanFirst Bank gained real-time insights to identify opportunities and improve returns faster than ever before.

Read our OceanFirst Bank Case Study to learn how.

Comprehensive Customer Profitability Reporting & Insights

- View your entire customer base by:

- Profitability

- Large balance fluctuations

- Loan maturities

- Renewals

- View profitability by:

- Account

- Offer

- Industry segment

- Branch

- Create what-if scenarios by:

- Relationships

- Loans

- Deposits

- Capture House holding view with:

- All personal accounts

- All business accounts

Trends & Insights