Borrower’s Loan Protection®

Loan Hedging Solution — Not Your Typical Interest Rate Swap

Loan hedging can give your institution a competitive advantage. With Borrower’s Loan Protection (BLP), you can protect your institution from interest rate risk and win new business without derivative accounting or complicated, lengthy documents.

Meet your customers’ needs with the competitive, fixed-rate payment structure they want, while your institution receives a floating rate over the full term of the loan.

Key Benefits:

- Reduce rate risk and credit risk

- No requirement for hedge accounting, capital or collateral by your institution

- Generate fee income

- No swap implications

- Retain and acquire customers

Close More Loans with BLP®

Most loan hedging solutions offer 10-year terms. However, PCBB can provide terms up to 25 years. Our extended term-length options will help you stay competitive and mitigate debt service coverage so you can offer attractive, longer-term loans to your customers.

What Sets Our Loan Hedging Solution Apart

- Lenders never post collateral, especially in a falling rate environment when liquidity and capital are most important.

- BLP does not encumber the lender’s capital or ability to take FHLB Advances.

- Lender’s total exposure to the borrower is the same for BLP as any other swap-based hedge and in some cases less.

Why Choose PCBB as Your Lending Partner

I can’t emphasize enough how good the BLP desk staff is, far and above our experience with the previous swap provider, your staff is very on top of it, and it makes a massive difference in getting these doors closed.

That’s where you guys shine, is making it really easy and simple. Because I think it can be very complex for us, PCBB does a good job of simplifying it for the lender.

Loan Types That Work for BLP Hedging

We partner with lenders and their borrowers to structure customized financing solutions at competitive rates. BLP supports a broad wide range of commercial loan applications, spanning both Commercial Real Estate (CRE) and Commercial & Industrial (C&I) asset categories.

Below are some of the more common asset categories used as collateral for BLP. We are flexible and ready to work with you.

Commercial Real Estate (CRE)

| Multi-family | |

| Owner-occupied | |

| Manufactured housing | |

| General Office | |

| Medical/Special Purpose | |

| Industrial | |

| Agriculture | |

| Hospitality | |

| SBA | |

| USDA |

Commercial & Industrial* (C&I)

| Construction & Ag Equipment | |

Industrial Storage Examples:

|

|

Transportation Examples:

|

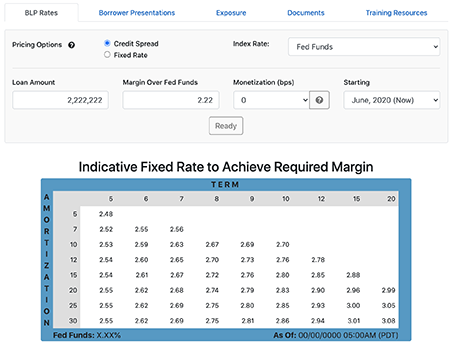

BLP Tools at Your Fingertips

As a BLP customer, you have access to marketing and loan pricing tools at no cost via our mobile-optimized BLP Portal. We provide you with resources and direct access to our team to support you in achieving your lending goals.

Discover what marketing tools we offer in our BLP Portal.